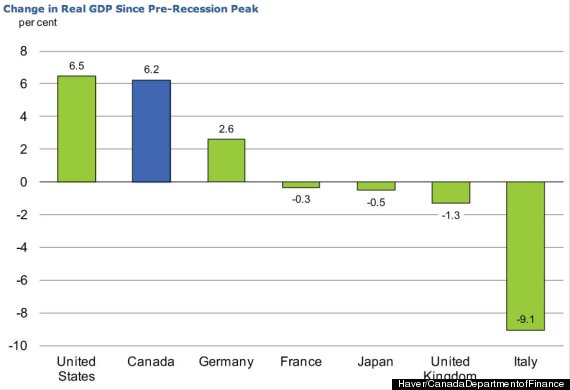

danivon wrote:The US economy is one of the fastest to have recovered from the 2008 crash. The depth and causes of that crash mean it will be relatively slow to recover anyway, but it does appear that part of the recovery is down to changes in healthcare recently.

Is that true that the deeper the depth of crash = speed of recovery is slower? That is the opposite of my understanding, but I am asking.

This is a contrary claim made in 2012:Today, , "It has typically taken countries up to ten years to recover from financial crises of this magnitude." In truth, however, has been as follows: the deeper the recession, the stronger the recovery.

For example, having inherited the Great Depression when he took office in 1933, FDR presided over what was probably the greatest year of peacetime economic growth in American history in 1936. According to the Obama administration's own Bureau of Economic Analysis (see ""), real (inflation-adjusted) growth in the gross domestic product was a whopping 13.1 percent in 1936. So far in 2012 (according to that same source), it has been 1.9 percent under Obama. In 2011, it was 1.7 percent.

It's true that, in 1938, America plunged into the second deep trough of the Great Depression. But at least under Roosevelt, we experienced a blend of peaks and troughs. Four years under Obama has been like one continuous, uninterrupted walk along the floor of a canyon.

In his speech, Obama also asserted, "Our economy started growing again six months after I took office. And it has continued to grow for the last three years."

Well, according to the federal government's own numbers (published by the Bureau of Labor Statistics), in July 2009, six months after Obama took office, was 59.3 percent. Since then, the employment rate has actually fallen to 58.6 percent — a tally that, except under Obama, we haven't seen in .

In fact, 58.6 percent employment barely exceeds from when President Eisenhower was running for reelection in 1956 — back before millions upon millions of American women entered the workforce.

This piece has more depth:

http://spectator.org/articles/35903/wor ... depressionRather that asking trick questions about the views of a journalist, perhaps you could provide actual evidence to contradict the facts as presented via that op-ed?

That op-ed said:

On the incomes side, the law’s expanded coverage boosted Medicaid benefits by an estimated $19.2 billion, according to Commerce’s Bureau of Economic Analysis. The ACA also offered several refundable tax credits, including health insurance premium subsidies, which added up to $14.7 billion.

Taken together, the Obamacare provisions are responsible for about three-quarters of January’s overall rise in Americans’ incomes.

Just wow. So, with an anemic recovery, 3/4 of it is from Obamacare for a one month period. What the author doesn't say: someone is paying for $19.2B in new Medicaid benefits. Hint: it's all borrowed. So, if the way to grow the economy is to continue piling up debt, is that sustainable, particularly when it's not a "booming" economy?

Given that the CBO has estimated the ACA will reduce hours worked, how can that be "good for the economy?"

There are any number of problems or potential problems--the medical device tax, the 29-hour limit, the unneeded mandates of the law--to question how the law could possibly be a benefit. The BEST argument anyone can make right now for the positive economic impact is "it's too soon to tell." Because any boasting about this economy is foolish.